Nearly 31% of Florida’s small businesses described their business’s current performance as excellent or above average in survey data captured at the beginning of the month. This data is just below the national average (31.5%) but slightly above other large states including California (26.9%), Texas (29.3%), and New York (24.4%). Last July, 37% of Florida’s businesses were reporting performance that was excellent or above average. These numbers when compared to the same data set from summer 2022 suggest that small businesses have struggled some in the wake of a year of high inflation, continuous supply chain difficulties, and a widespread labor shortage.

This data comes from the Business Trends and Outlook Survey (BTOS) in a biweekly business climate survey done by the U.S. Census Bureau. The survey is a follow-on to the Small Business Pulse Survey launched in the peak of the COVID-19 pandemic. In that same spirit, BTOS aims to provide local, state, and federal officials near real-time data for policy and decision-making including after natural disasters or during economic crises.

The Florida SBDC Network monitors BTOS and other real-time data measures to continuously evaluate the needs of our state’s small businesses and evaluate how to better serve them. In general, the survey asks small businesses to evaluate their current performance, activities over the last two weeks, and anticipation of their business needs over the next six months. This blog looks at the data collected and published on June 4, 2023. Florida’s data was pulled and benchmarked against the national average, in addition to the other most populous states - California, Texas, and New York.

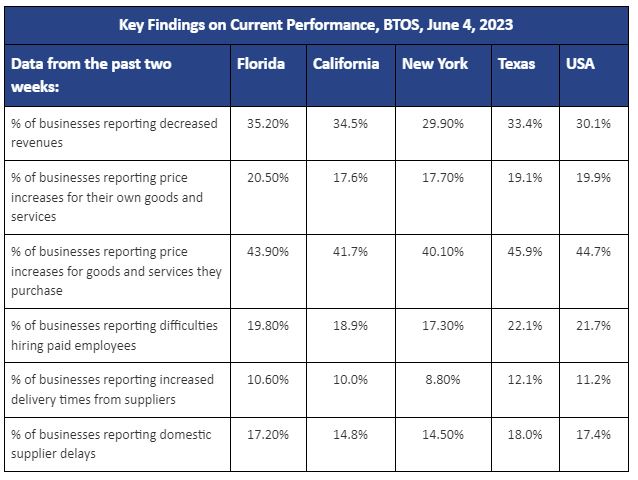

In the last two weeks, more than one-third (35.2%) of the small businesses polled in Florida reported decreased operating revenues and more than 20% reported having to increase their prices charged for goods and services. Even more striking, nearly 44% of the state’s businesses reported the prices they are paying for goods and services had increased over the past two weeks.

Importantly, reports of increased delivery times in Florida have decreased about 14 percentage points since last summer - only 10.6% of Florida businesses reported increasing delivery times from their suppliers earlier this month. However, some aspects of these supply chain challenges remain. Coupled with the difficulties of hiring workers means that small businesses need the support of Florida’s business ecosystem, including the Florida SBDC Network, even more right now. (Small businesses can request consulting here.)

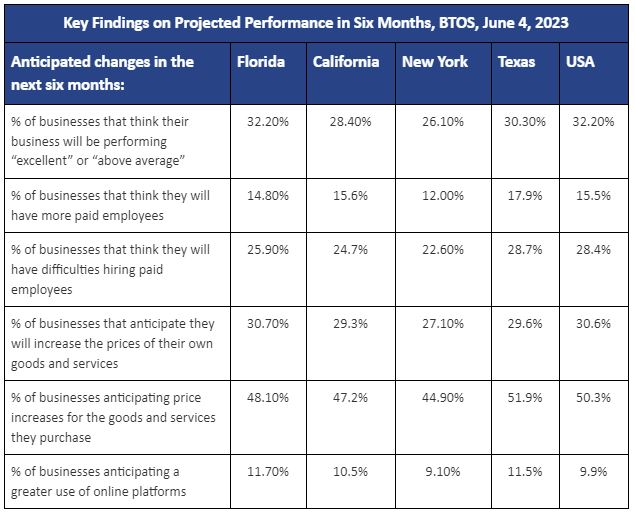

Looking to the future, about 60% of businesses felt like they could only predict their business’ performance over the next six months. Overall, the share of businesses that were anticipating excellent or above average performance was not much different from their current status.

While businesses anticipate they will have more paid employees, they also anticipate in even greater numbers (26%) that they will have difficulties hiring. Moreover, nearly a third of businesses reported that they will have to increase their own prices and nearly half reported increases of the goods and services they purchase. Both of those trends are similar to the national average and the experiences of other small businesses in large states.

About 12% of Florida’s small businesses anticipate that they will need to rely on online platforms in a more substantial way. This trend has been clear for some time - technology adoption has become even more important with the challenges in this current business climate. In response to those needs, the Florida SBDC Network’s upcoming Small Business Success Summit highlights the technology needs and resources of small businesses. To learn more, check out the agenda and register here.

About the Florida SBDC Network:

The Florida SBDC Network, state designated as Florida’s principal provider of small business assistance, is a statewide partnership program nationally accredited by the Association of America’s SBDCs and funded in part by the U.S. Small Business Administration, Department of Defense, State of Florida, and other private and public partners, with the University of West Florida serving as the network’s headquarters. Florida SBDC services are extended to the public on a nondiscriminatory basis. Language assistance services are available for individuals with limited English proficiency. All opinions, conclusions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA or other funding partners.

About the survey:

The BTOS sample consists of approximately 1.2 million businesses split into six panels (approximately 200,000 cases per panel). Businesses in each panel are asked to report once every 12 weeks for a year. Data collection occurs every 2 weeks. The U.S. Census Bureau estimates that it will take the average respondent approximately 6 minutes to complete the survey, including the time for reviewing the instructions and answers.

BTOS data are representative of all single location employer businesses in the U.S. economy, excluding farms. Data are released every 2 weeks and are available by North American Industry Classification System (NAICS) sector, by state and for the 25 most populous Metropolitan Statistical Areas. Data are also available by subsector (3-digit NAICS) and state by sector.

Wtitten by:

Amy Newburn

Research & Data Analyst Director

Florida SBDC Network State Office