As Florida’s recovery continues, business owners are showing confidence in stability of the state’s economy, according to the Florida SBDC Network’s most recent annual survey of small business clients.

As Florida’s recovery continues, business owners are showing confidence in stability of the state’s economy, according to the Florida SBDC Network’s most recent annual survey of small business clients.

Three quarters of those surveyed said they expected their sales to increase in 2016, with 49 percent expecting a moderate increase and another 26 percent expecting their sales to increase significantly.

Stability and growth can be seen in hiring, as 48 percent of respondents reported they expected to maintain their current staffing levels, while 40 percent said they would increase hiring moderately and another eight percent said they expected to increase their workforce significantly.

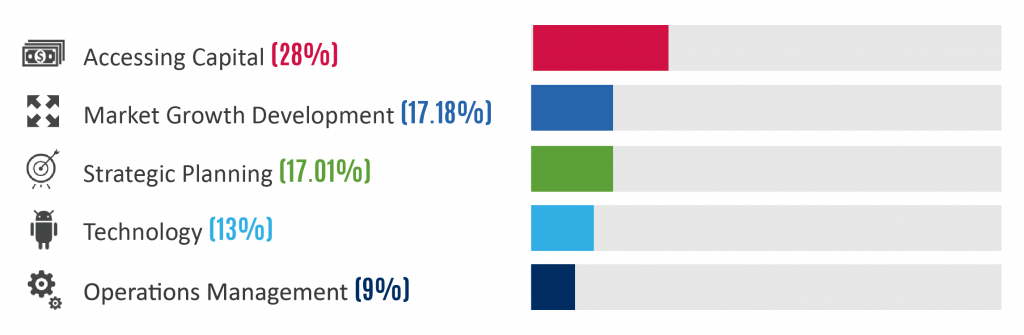

The survey indicated that the top challenge facing Florida’s small businesses is accessing capital or financing (28 percent), followed by market growth development (17.18 percent). Access to capital was also the top issue reported last year.

Other challenges included strategic planning (17.01 percent), technology (13 percent), and operations management (9 percent).

Top Challenges Facing Florida Small Businesses

“Access to capital remains the greatest barrier for Florida’s small businesses,” said Michael Myhre, CEO and Network State Director for the Florida SBDC. “Though the economy continues to improve, entrepreneurs and small business owners are still struggling to obtain the capital necessary to grow their enterprises.”

This article is a series as part of the 2016 State of Small Business Report: Small Business and Its Impact on Florida, a report developed by the Florida SBDC Network in collaboration with the University of West Florida Center for Research and Economic Opportunity. To read the full report, please click here.