Access to capital is the greatest challenge facing Florida small businesses, with 28 percent of respondents saying it was a problem, according to the Florida SBDC Network’s most recent annual survey of small business clients.

Access to capital is the greatest challenge facing Florida small businesses, with 28 percent of respondents saying it was a problem, according to the Florida SBDC Network’s most recent annual survey of small business clients.

In an effort to further examine the issue, the Florida SBDC Network recently partnered with the Federal Reserve Bank of Atlanta to collaborate on the “Small Business Credit Survey: Report on Employer Firms” to offer data to help understand the dilemma that businesses face not only in Florida, but also across the country. [1]

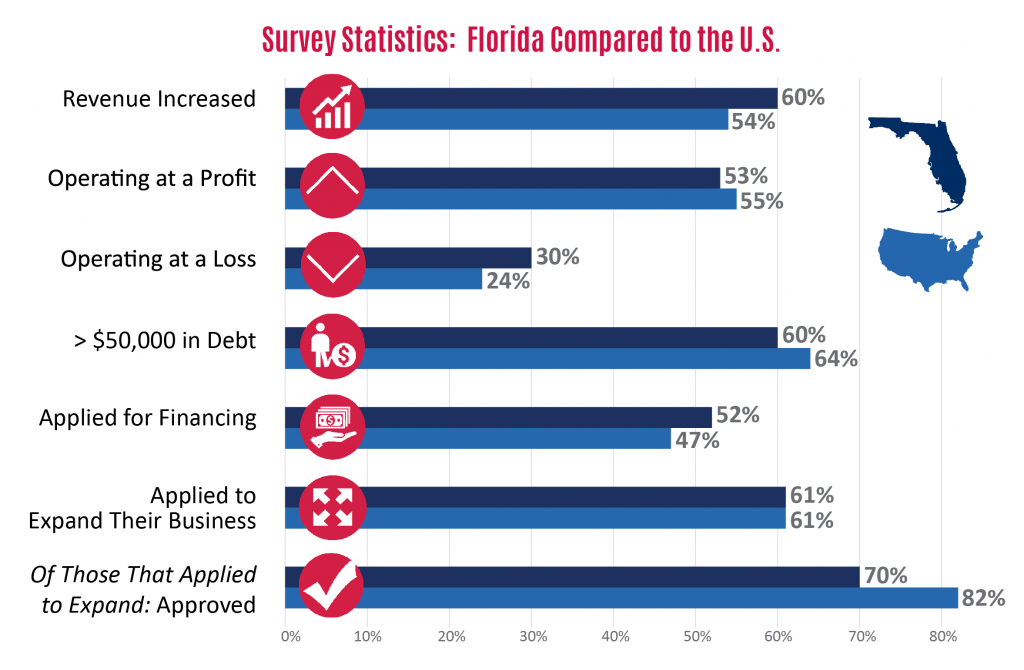

Florida’s statistics aligned closely with those nationally, with 60 percent of Florida businesses reporting that their revenue increased last year. Nationally, 54 percent said their revenue was up.

But, Florida businesses faced a tougher road in several categories, with only 53 percent operating at a profit and 30 percent operating at a loss. In the U.S., 55 percent of small businesses were at a profit, while only 24 percent had losses.

Debt was also a looming issue for Florida – 60 percent reported that they were more than $50,000 in debt, while 64 percent reported that amount nationally. Fifty-two percent of Florida businesses had applied for financing in the past year, while only 47 percent had nationally.

The positive was that 61 percent of businesses, both in Florida and on the national level, applied for funds to expand their businesses. Of these, 70 percent were approved in Florida, while nationally 82 percent were approved.

[1] Small Business Credit Survey: Report on Employer Firms, Federal Reserve Banks of Atlanta, New York, Boston, Cleveland, Philadelphia, Richmond, and St. Louis (2015)

This article is a series as part of the 2016 State of Small Business Report: Small Business and Its Impact on Florida, a report developed by the Florida SBDC Network in collaboration with the University of West Florida Center for Research and Economic Opportunity. To read the full report, please click here.